Indian Budget 2023: An Ease for Foreign investors??

On February 1, the largest democracy of the world, India has presented its new annual budget for its upcoming session 2023-2024. The Finance Minister Shri. Nirmala Sitharaman has estimated the economic growth of 6.8% for the year 2023.

Like every year, the Union budget is predictable, practical and stable in nature. India as a nation is untapped with its undefining potential comprised of a large demography, largest diaspora, fastest emerging tech advancement, steering growth of manufacturing sector, tourism attractions, and a pleasant destination for foreign investments.

Undoubtedly, India is one of the fastest emerging global power in the world and it is one of the reasons the world keeps its eyes on the transforming Indian budget every year. The event becomes important from the business & investment perspectives. As per the records, India touched the $50 billion investment mark for the three consecutive years.

Here are the two key features highlighted in the Budget impacting foreign investors at a large scale in India.

Non Residents under Angle Tax regime

Angle Tax is an income tax payable on the capital raised by startups via the issuance of shares when the share price exceeds the fair market value of the share sold. Precisely, this excess realization is considered as an income of the startups or an unlisted company. Hence, this generated income of the company is subjected to Income tax under the roof of “Income from other Sources”.

Earlier, the tax is collected on the investments raised by the resident Indian investors only. But in line with the Budget 2023, the ambit of Angel tax is extended to the non-resident investors and foreign investors under section 56(2) (vii(b). It would adversely affect the financing of the startups. Now the investments by a non-resident in shares, the startup would need an Income Tax valuation report from a Merchant Banker.

In addition to this, the investment has to be made at a value lower or equal to the fair market value which is in contrast to the FEMA Act. FEMA Act has norms of investments done at a higher value than the fair market value. Moreover, there is a huge possibility of startups shifting overseas as foreign investors would not want to bear an additional liability of tax on their investments.

Promoting Ease of Doing Business

The Gujrat International Finance Tech City which is India’s first and only International Financial Services Center (IFSC). A hub of domestic and international companies. In the Budget 2023, Indian Government has put forward a proposal of streamlining the regulations of IFCS. Presently, all the laws relating to regulating and arbitrary cases in IFSC’s is dealt by Special Economic Zone Act 2005. But now the government is in thoughts of shifting the powers from SEZ to an IFSC authority. It would avoid the complexities of dual regulations.

Along with that, government is emphasizing on a digital single-window mechanism for registrations and approvals from authorities such as SEZ, IFSC, IRDAI, RBI and the SEBI. It would further facilitate the scope of Ease of Doing Business and increase India’s global competitiveness.

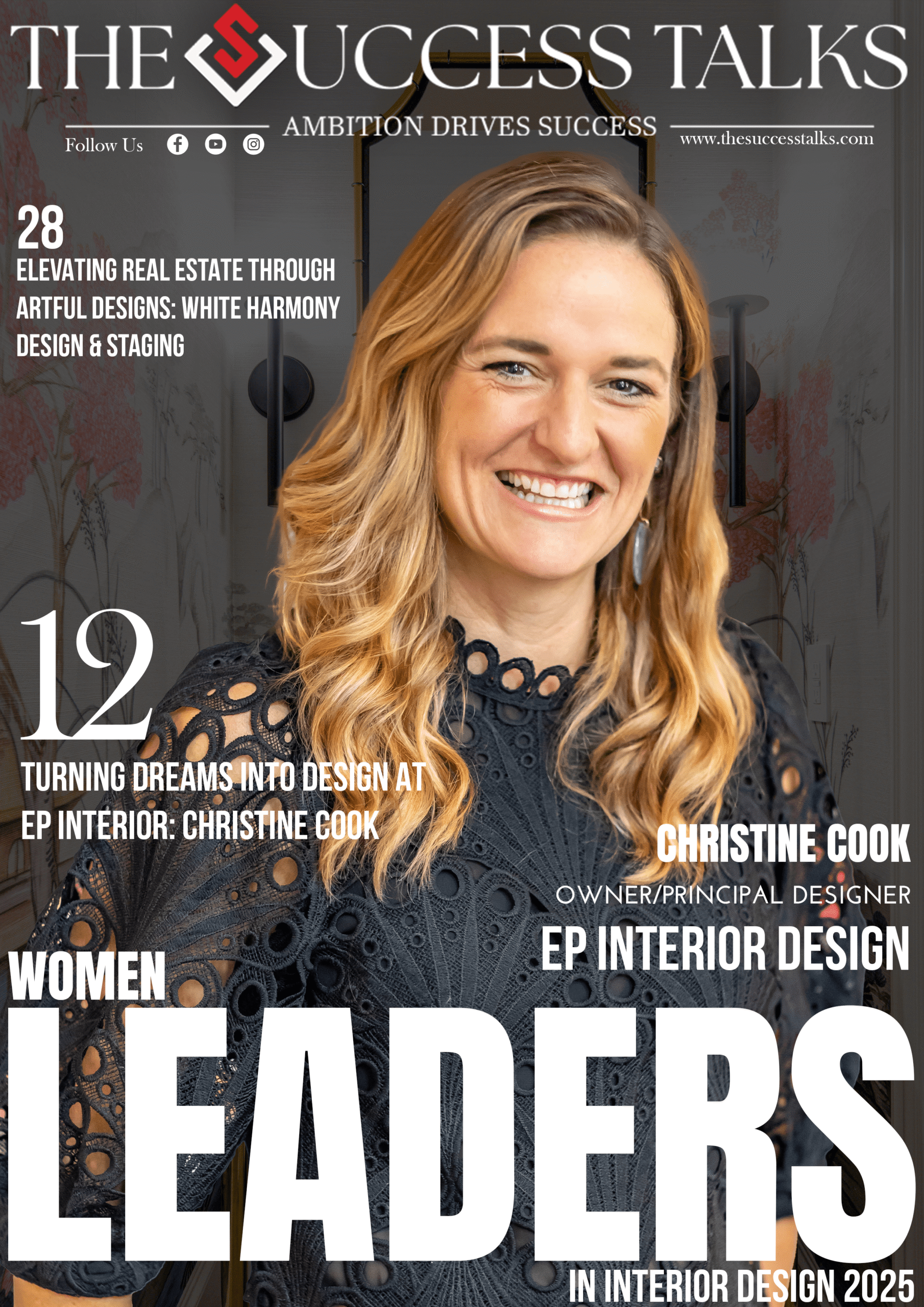

The budget has a calculating impact on foreign investors showing a perfect blend of cautions and opportunities. however, it is to be noted that Foreign investment has decline over 50% to $1.11 billion in 2022. It would be desirable to see how the mechanism of foreign investments take place in the upcoming times in lines with the above mentioned budgetary provisions. The Finance Minister and the present Narendra Modi Government has described the budget as the first budget of the “Amrit Kaal” (Golden Era).

Must Read:-