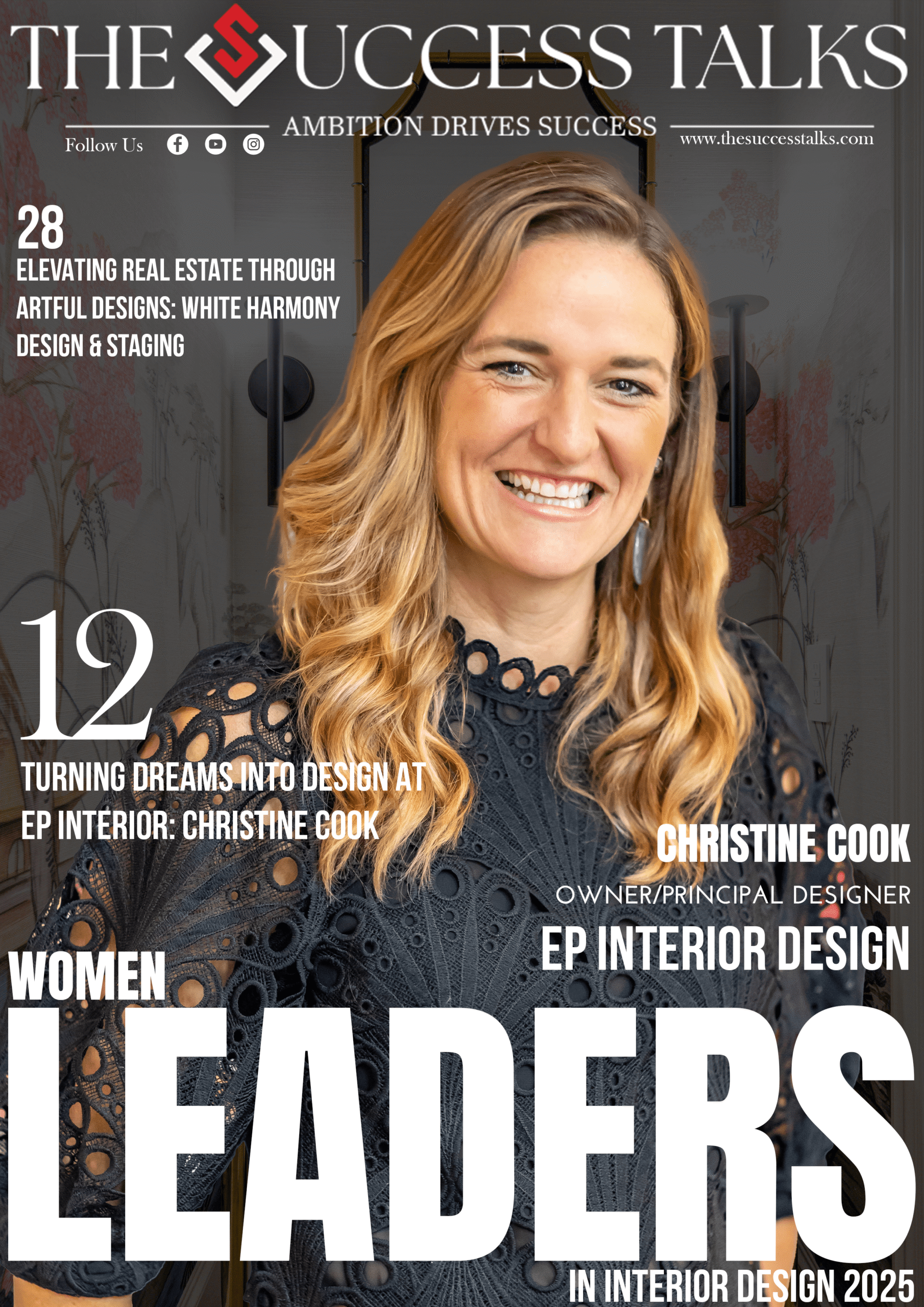

Top 15 Federal Dependency States in the US

Many states are dependent on federal funding. Most states provide returns on taxes to the government, and the federal government offers a percentage of each state’s revenue to the states. We have analyzed the data of the moneygeek and ranked the 15 top states that are reliant on federal aid. The analysis includes political affiliation by color, dependency score, return on tax dollars, federal funds percentage of state revenue, and their GDP.

The color blue and Red are the states showing Democrat and republican states. And how much a state gets a return on the tax dollars. The Federal fund means how much the government is funding the state. This will help the people of the United States to look at how much they are dependent on federal aid and how much they are giving the taxes to the state as compared to the other state people.

So here is the List of the Top 15 Federal Dependency States in the United States

1. New Mexico

- Political Affiliation: Blue

- Dependency Score: 100.0

- Return on Tax Dollars: $3.42

- Fed Fund % of State Revenues: 30.7%

- GDP: $130,202M

2. West Virginia

- Political Affiliation: Red

- Dependency Score: 94.6

- Return on Tax Dollars: $2.91

- Fed Fund % of State Revenues: 27.0%

- GDP: $99,511M

3. Alaska

- Political Affiliation: Red

- Dependency Score: 93.5

- Return on Tax Dollars: $2.65

- Fed Fund % of State Revenues: 29.0%

- GDP: $67,337M

4. Mississippi

- Political Affiliation: Red

- Dependency Score: 90.5

- Return on Tax Dollars: $2.66

- Fed Fund % of State Revenues: 25.9%

- GDP: $146,401M

5. District of Columbia

- Political Affiliation: Blue

- Dependency Score: 87.7

- Return on Tax Dollars: $1.71

- Fed Fund % of State Revenues: 32.2%

- GDP: $174,796M

6. Alabama

- Political Affiliation: Red

- Dependency Score: 86.4

- Return on Tax Dollars: $1.90

- Fed Fund % of State Revenues: 26.7%

- GDP: $300,152M

7. Kentucky

- Political Affiliation: Red

- Dependency Score: 84.2

- Return on Tax Dollars: $1.68

- Fed Fund % of State Revenues: 30.1%

- GDP: $277,747M

8. Arizona

- Political Affiliation: Red

- Dependency Score: 80.1

- Return on Tax Dollars: $1.62

- Fed Fund % of State Revenues: 28.5%

- GDP: $508,344M

9. Montana

- Political Affiliation: Red

- Dependency Score: 79.5

- Return on Tax Dollars: $1.43

- Fed Fund % of State Revenues: 31.8%

- GDP: $70,560M

10. Maine

- Political Affiliation: Blue

- Dependency Score: 78.8

- Return on Tax Dollars: $1.78

- Fed Fund % of State Revenues: 23.3%

- GDP: $91,081M

11. Hawaii

- Political Affiliation: Blue

- Dependency Score: 77.1

- Return on Tax Dollars: $1.94

- Fed Fund % of State Revenues: 20.6%

- GDP: $108,023M

12. Louisiana

- Political Affiliation: Red

- Dependency Score: 76.0

- Return on Tax Dollars: $1.33

- Fed Fund % of State Revenues: 29.8%

- GDP: $309,601M

13. Maryland

- Political Affiliation: Blue

- Dependency Score: 75.8

- Return on Tax Dollars: $1.79

- Fed Fund % of State Revenues: 21.2%

- GDP: $512,280M

14. Virginia

- Political Affiliation: Blue

- Dependency Score: 71.7

- Return on Tax Dollars: $1.91

- Fed Fund % of State Revenues: 18.2%

- GDP: $707,085M

15. South Carolina (South)

- Political Affiliation: Red

- Dependency Score: 64.4

- Return on Tax Dollars: $1.60

- Fed Fund % of State Revenues: 19.5%

- GDP: $322,259M

Conclusion:

The above data shows that the states having the high GDP per capita are less reliant on the federal aid given by the government this means that the states with higher income produce more of the Tax dollars which will eventually go into the bucket of the federal government and this also shows that the people of the higher income states are less dependent on the federal government comparing to the people of the less income-generating states. Both the Republican and democratic states received more from the federal government in 2024. Hopefully, this blog will encourage people in the United States to learn about federal aid.

Must Read:-