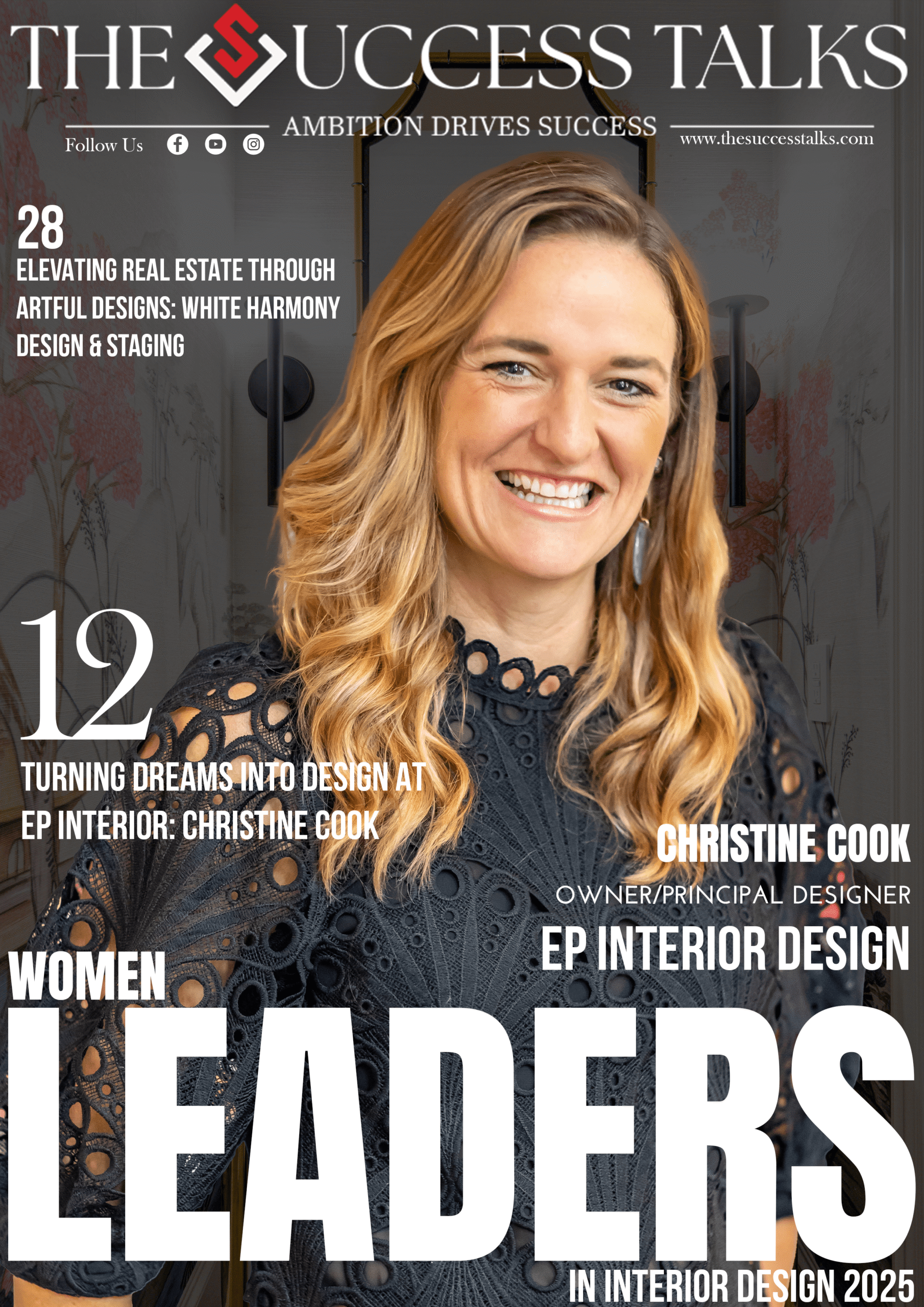

The public authority has recorded the Financial Laws (Change) Bill 2021, which will take up through the Colder time of year Meeting of Parliament to privatize two public region banks as a component of the Rs 1.75 lakh crore disinvestment centre in the current money related year.

Which 2 PSU banks will be privatized?

The Center has, as of now, proposed to privatize the Indian Overseas Bank (IOB) and the Central Bank of India, as per reports. It is essential for the Rs 1.75 lakh crore disinvestment plan of the public authority that was declared before by the experts for the current financial year.

The enactment is one of the 26 bills that are planned to be presented during the meeting.

The bill plans “to impact changes in Banking Companies (Acquisition and Transfer of Undertakings) Acts, 1970 and 1980 and coincidental corrections to Banking Regulation Act, 1949 with regards to the Union Budget declaration 2021 in regards to privatization of two Public Sector Banks.”

Cash Priest Nirmala Sitharaman, in the Association Financial plan 2021-22, announced that two public region banks would be privatized as a part of the public power’s disinvestment target.

Sources say that the bill isn’t probably going to specify the names of the two banks that will be privatized. All things being equal, the public authority would make empowering enactment for privatization of public area banks.

*Rationale FOR AMENDMENT TO BANKING LAW

There is a convincing rationale for making an empowering enactment rather than a particular objective law. In India, there have been two in number moves to nationalize banks. The initiative was in 1969 and the second in 1980. Altogether, 34 banks were nationalized.

For the bank nationalization process, a demonstration of Parliament was made. This was separated from the particular law that made the State Bank of India (SBI) the country’s most prominent public area bank.

Throughout the long term, public area banks’ shape and forms changed through blends that didn’t expect changes to the current financial laws. Notwithstanding, the public authority needs to acquaint laws in Parliament with ‘denationalize’ or privatize banks.

*Annuity BILL LIKELY IN WINTER SESSION

Another huge bill liable to be presented in the impending Parliament meeting is the Pension Fund Regulatory and Development Authority (Amendment) Bill, 2021. Its motivation is to correct the Pension Fund Regulatory and Development Authority (PFRDA) Act.

The correction will work with partitioning the National Pension System Trust from PFRDA as reported by the money services in the last financial plan to advance more extensive annuity inclusion.

The correction is probably going normal to characterize the powers, capacities, and obligations of the National Pension Scheme Trust, characterized in the PFRDA (National Pension System Trust) Regulations 2015. The trust might get moved under the organizations go about a charitable trust.

The offer costs of the Indian Abroad Bank and the National Bank of India rose by as much as 15 to 20 percent on Wednesday, following the reports of their privatization.

Must Read:-