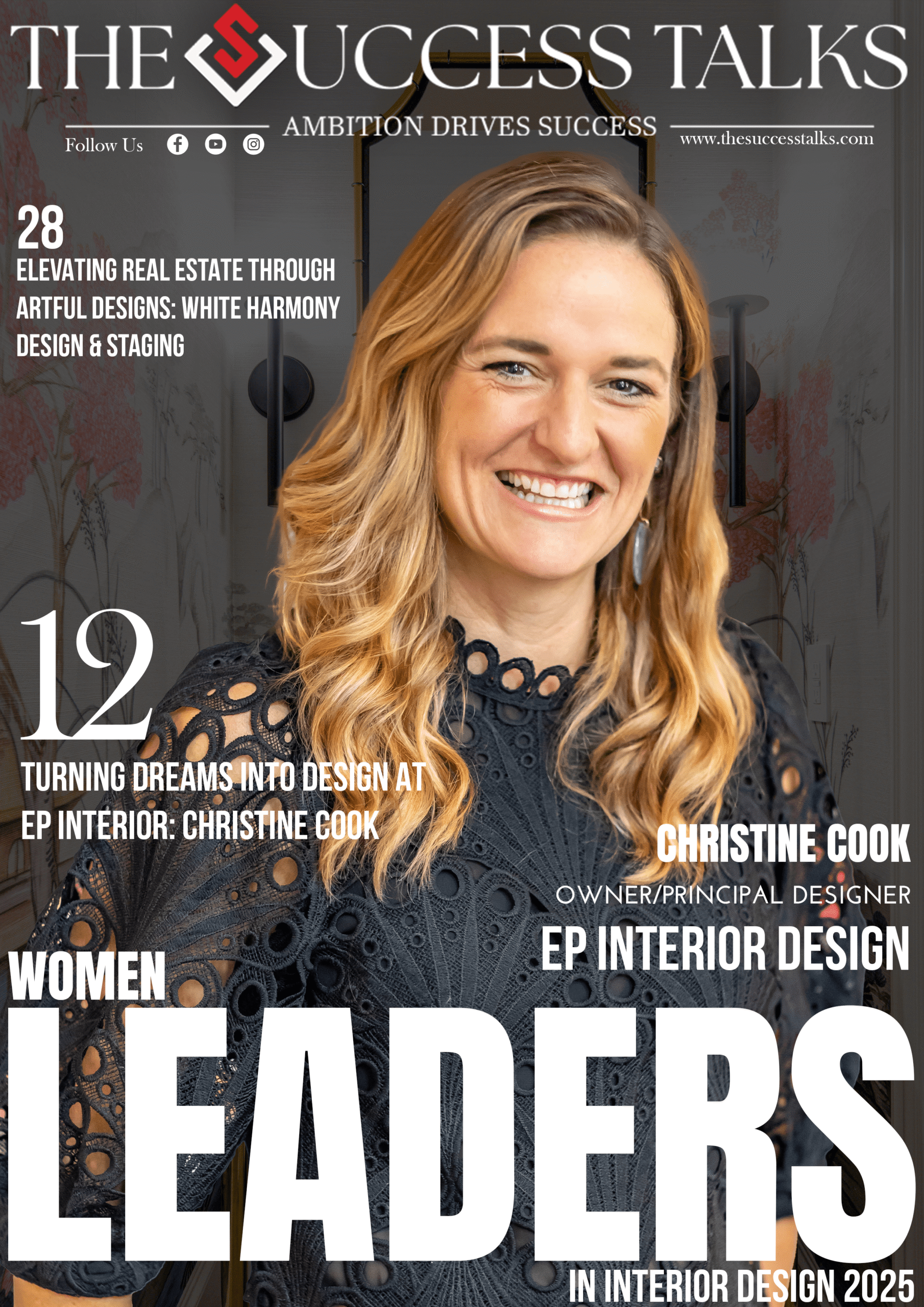

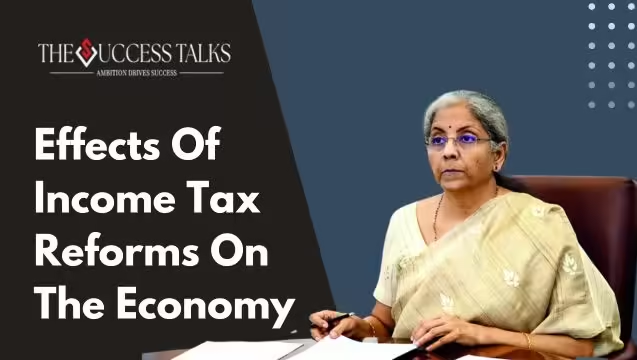

Effects Of Income Tax Reforms On The Economy

In Applicable modification of the income tax slabs under the newly established tax structure, modification to capital gains taxation mechanism, enhancement of together deductible allowance, modification of TDS-TCS rates, and other worthy changes were proposed by Nirmala Sitharaman.

These various revisions to the income tax regime have been designed to offer taxpayers relief while simultaneously spurring the trajectory of economic expansion.

Here are key highlights of the current changes in income tax policy:

- The rate of TDS on house rent payments of more than Rs 50,000 per month was cut to 2% from 5%.

- No more reopening, or re-assessment of old ITR beyond 3 years if the income not disclosed is below Rs 50 lakh.

- House rental income can not be declared as business income to save tax.

- Private firms now contribute a tax-exempt 14% of their employees’ salaries to the NPS, up from 10% previously.

- The time limit for which income tax survey can be done is reduced.

- Gold and silver have become cheaper, customs duty slashed to 6%.

- TCS (Tax Collected at Source) paid on foreign payments, purchase of a car can be used to lower TDS (Tax Deducted at Source) on salary.

- Gold investment to attract LTCG (Long Term Capital Gains Tax) tax of 12.5% instead of 20% with indexation, holding period cut to 24 months.

- The following holding periods (LTCG AND STCG) are also modified for capital gains calculation of equity, property, gold, financial, and non-financial assets.

- Now, the employees of the private sector are allowed to increase the contribution deduction cap in NPS from 10 % to 14%. Withdrawn was the property sale indexed benefit; a new capital gains tax rate of 12 percent. 5% was implemented.

- Securities transaction tax (STT) on F&O boosted to 0.02% and 0.1%.

- The capital gains exemption ceiling has been raised to Rs. 1.25 lakh.

- New income tax slabs are announced in the new tax regime.

- LTCG increased to 12.5% from the existing 10%.

- STCG cut to 20% on certain financial assets, and 12.5% on LTCG.

- Exemption of capital gains increased to Rs. 1.25 lakh per year for certain assets.

- New NPS scheme for minors announced: Parents can plan pension for their kids which will be transferred to them once they attain majority.

These Guidelines: Things You Should Know

-

TDS as a portion of rental income

For residential rent payments above Rs 50,000, whether full or partial, the TDS deduction was reduced from 5% to 2%.

Reopening an assessment after three years to look into revenue evasion over Rs 50 lakh is permitted within five years of the assessment year. The following are the proposals: Cut down the time limit to search cases to six years from the search year to boost efficiency and scale down differences to render tax obligations clearer to adapt efficiency and standardization.

-

Tax savings by declaring home rental tax as business income tax is not allowed.

However, as per the recent changes, the expense has been legally bound to the extent provided under the head of income of the house property. Hence, whether let-out house property is reasonably anticipated to be let out after the addition of the new section 24 violation, some individuals who formerly fell under the PGBP heads of income might encounter a rise in their tax payable as a direct result of this change. This alteration signifies a significant shift impacting tax liability specifically concerning rental income from property.

-

NPS contribution limit for employer

The maximum amount that the private sector can contribute to NPS was raised from 10% to 14% of an employee’s base pay. All these benefits are only available under the new tax structure. Employees who choose the new tax regime will now be eligible for a larger deduction under Section 80CCD(2) of up to 14% of their base pay for contributions made to the NPS by their employers. They will be able to create and save more taxes because of this.

-

The time limit for reassessment has been reduced.

It is suggested that the ten-year evaluation period be shortened to five years. Additionally, there are plans to rationalize the reassessment process. In addition, it is proposed that section 275 be amended to remove any mention of the Principal Chief Commissioner or Chief Commissioner to make the deadline for imposing penalties more clear. Additionally, it is suggested to rationalize the section 253 time restriction for filing an appeal with ITAT and to suspend reimbursement of assessments for up to sixty days under section 245.”

-

Gold and silver become cheap.

The anticipated reduction in customs tax from 15% to 6% has caused a price correction of almost 4000 points, and this should also be reflected in domestic prices. Retail clients will benefit from it because of its quick impact, according to Pranav Mer, vice president of JM Financial Services Ltd.’s EBG-Commodity & Currency Research.

-

TCS paid on foreign remittances to reduce TDS on salary

Now, while computing the Tax Deducted at Source (TDS) on salaries, employers can take into account the Tax Collected at Source (TCS) associated with their employees’ foreign remittances or any other remittances (like TCS on a car, etc.). Employee TDS deductions can now be lowered thanks to this modification, which also makes it easier to file a refund for unpaid taxes.

-

Shorter holding time for gold capital gains

Those with short-term capital gains on gold will still be subject to the income tax slab rate.

The new gold capital gains regulations take effect on July 23, 2024, following the parliament’s approval of the budget proposal.

As per the explanatory memo of the budget, the short-term capital gains tax has been hiked to 20% on all financial assets, while the long-term capital gains tax was raised.

-

The LTCG and STCG holding periods have been modified.

It is put into practice so that capital gains taxation can be more rational and simple. There are three components to the simplification. First, it is recommended that the 12 and 24-month holding periods be the only two considered to determine whether capital gains are long-term or short-term. The holding time is proposed to be 12 months for all listed securities and 24 months for all other assets.

-

NPS contribution deduction limit raised

“It is suggested that businesses remove 10 to 14 percent of an employee’s income as their NPS expense to enhance social security benefits. Minister of Finance Nirmala Sitharaman mentions that one can partly rely on the undertaking profits, private sectors and bank undertakings, salary, and earnings. Particularly, Section 80CCD (1), Section 80CCD (1B), and Section 80CCD (2) of the Income-tax Act 1961 allow a deduction and set out the tax advantage for investment in NPS depending on the tax plan opted for.

Securities transaction tax (STS) on F&O is boosted.

-

Standard deduction has hiked.

A finance minister has informed that a standard deduction amount is to be raised to Rs 75000 under the new tax regime. In addition, the pertinent standard deduction limit has been enhanced to Rs. 25000 from Rs. 15000 for the family pensioners.

If the standard deduction was increased, pensioners and salaried individuals would save more money on taxes. After five years, there has been an increase in the standard deduction. In the previous interim budget, the standard deduction was increased to Rs 50,000

That is so since new income tax slabs are announced in the regime.

Prior fiscal year 2023–2024 income tax was reduced by Independent Finance Minister Nirmala Sitharaman by relaxing the new taxation slab.

-

NPS Plan for Younger People

Therefore by affording the NPS Vatsalya plan for their children, parents can be able to make extra arrangements for their kids’ future economically. This scheme allows the parents and guardians to periodically save for the future to provide his/ her children with a pensionary need in the future. It provides a solid means of guaranteeing that youths will be financially secure in the future thus eliminating the stress and anxiety that comes with the aspect.

Tax benefits on NPS

-

Tax benefits to employees on Self-contribution

Within the overall Rs. 1.50 lakh ceiling under Sec. 80 CCE, tax deductions up to 10% of pay (Basic + DA) are allowed under section 80 CCD(1).

In addition to the overall cap of Rs. 1.50 lakh under Sec. 80 CCE, there is a tax deduction of up to Rs. 50,000 under section 80 CCD(1B).

-

Tax benefits to employees on employer’s contribution

Up to 10% of pay (Basic + DA) (or 14% if the Central Government makes such a contribution) and over the Rs. 1.50 lakh ceiling set under Section 80 CCE, employer donations made under Section 80 CCD(2) may be subtracted from taxes.

-

Tax benefits to self-employed

The facility of tax deduction of 20% of gross income allowed in flowing years u/s 80 CCD (1) however the same is to be restricted to a residential cumulative limit of Rs. Up to Rs. 50 lakh under Section 80 CCE.

Besides, the carry-forward and overdraft limit restrictions are: The total quantum of funds that can be carried forward to the next fiscal is limited; it cannot be more than Rs. under Sec. 80 CCE there may be a deduction up to Rs. 50000 and there is an additional deduction of Rs. 50000 under section 80 CCD (1B).

CONCLUSION

Some of the current changes are many increases in income tax rates that are indications of new regimes and policies. All these tax changes are in a bid to bring lasting positive changes to the general public through the introduction of reforms domiciled on the improvement of the economic status of common persons facing various reconstruction hardships.

Read More:- Marvel Studios: Deadpool & Wolverine